The online loan marketplace is teeming with platforms, each promising the best deals. However, LendingTree stands out, offering superior features that put it a notch above its competitors.

One of LendingTree’s most powerful features is its loan comparison tool. This tool allows users to compare loans from multiple lenders simultaneously, providing a holistic view of the options available. Users can easily compare interest rates, loan terms, and other critical factors, helping them find the best deal. In contrast, many platforms only provide information about their own loans, limiting the user’s ability to compare and make an informed choice.

Another standout feature of LendingTree is its personalized loan recommendations. Based on a user’s unique financial situation and needs, LendingTree suggests the most suitable loans. This personalized approach simplifies the loan selection process, saving users time and effort. Many platforms, however, do not offer such personalized services, making the loan selection process more challenging for users.

LendingTree also provides a wealth of educational resources, including articles, calculators, and guides. These resources help users understand the complexities of borrowing, empowering them to make informed decisions. On the other hand, many platforms lack such extensive educational resources, leaving users to navigate the loan process with less guidance.

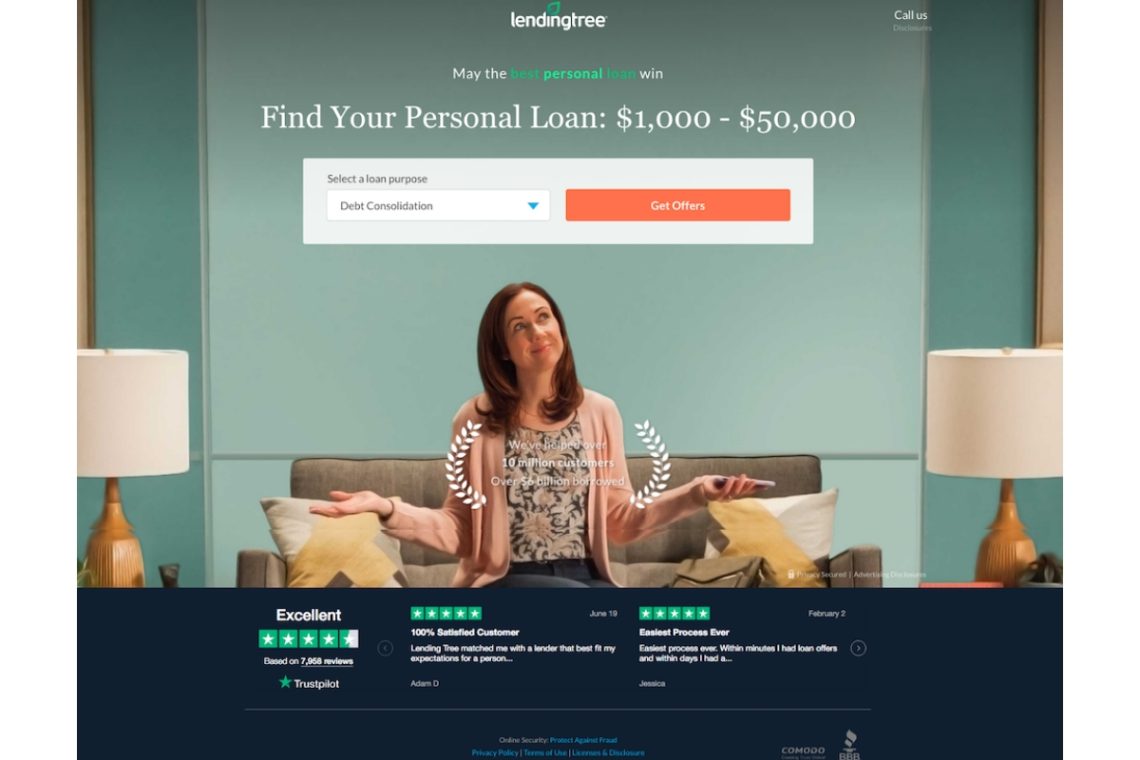

Unlock Better Borrowing with LendingTree.

In conclusion, LendingTree’s powerful comparison tools, personalized recommendations, and extensive educational resources make it a standout choice in the crowded online loan marketplace. For users seeking a platform that offers more than just loans, LendingTree is worth considering.